With the Fed, the Bank of England and recently the Bank of Japan engaging in massively expansionary monetary policy, central banks in South Africa, India, Australia, Poland, Korea, Denmark, Israel and elsewhere are lowering their interest rates too. They are doing this to stimulate growth and in some cases prevent their currencies from appreciating and hurting exports. To the extent it’s the latter, these actions blunt some of Bernanke’s objectives.

Tag Archives: expansionary monetary policy

Reserved Federal Reserve

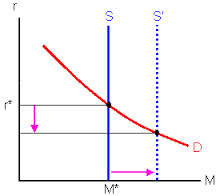

As the economy strengthens, the Fed must begin to end its exceptionally expansionary monetary policy of the last half decade. It will begin by halting its purchases of $85 billion/month in Treasuries and mortgage-backed-securities. Second, it will stop reinvesting interest and principal on its holdings. Third, it will start raising overnight interest rates and lastly it will slowly liquidate its vast holdings of long-term debt. This process will take years.

Invisible Inflation

While the economy is improving, inflation is MIA. Wages adjusted for inflation were up just 0.3% in 2012 after falling 1% in 2011. Meanwhile, the CPI and core CPI (excluding food and energy) were up 1.7% and 1.9% respectively in 2012. Similarly, the producer price index (PPI) and core PPI were up just 1.3% and 2.0% in 2012. With inflation this benign, the Fed will continue its expansionary monetary policy.

Banking the Bucks

Despite what you think, monetary policy has not been expansionary, and that’s the problem. While the Fed’s assets grew from $0.8 trillion to $2.8 trillion between 10/08 and 7/11, it was matched, almost dollar for dollar, by a $1.6 trillion increase in commercial bank deposits at the Fed. The money supply cannot expand when banks keep their excess reserves at the Fed. It only grows when banks lend those monies to businesses and households.