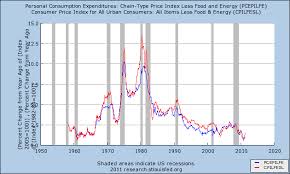

Despite fears of inflation, it’s currently benign no matter how measured. The CPI is up 2.1% year-over-year while the core CPI (which removes food and energy) is up just 1.9%. The PCE, the Fed’s preferred inflation measure, is up 1.6% Y-o-Y with the core up 1.5%. Economy wide inflation is at 1.6% Y-o-Y, and average hourly earnings are up 2% over the past year. Short term rates aren’t rising soon.

Despite fears of inflation, it’s currently benign no matter how measured. The CPI is up 2.1% year-over-year while the core CPI (which removes food and energy) is up just 1.9%. The PCE, the Fed’s preferred inflation measure, is up 1.6% Y-o-Y with the core up 1.5%. Economy wide inflation is at 1.6% Y-o-Y, and average hourly earnings are up 2% over the past year. Short term rates aren’t rising soon.

Tag Archives: CPI

Alternative Approaches

Inflation as measured by the CPI is 2.1%, as measured by personal consumption expenditures (PCE) is 1.6%, below the Fed’s 2% target. Importantly, the Fed uses the PCE to monitor inflation. Historically, the PCE is 0.5% lower than the CPI, as is the case now. The reason; the PCE accounts for changes in consumer buying habits as prices change, and it covers more than just out-of-pocket spending, like medical care.

Invisible Inflation

While the economy is improving, inflation is MIA. Wages adjusted for inflation were up just 0.3% in 2012 after falling 1% in 2011. Meanwhile, the CPI and core CPI (excluding food and energy) were up 1.7% and 1.9% respectively in 2012. Similarly, the producer price index (PPI) and core PPI were up just 1.3% and 2.0% in 2012. With inflation this benign, the Fed will continue its expansionary monetary policy.

Laboring On

Last Friday’s mediocre employment report gives the Fed (meeting this week) ample reason to continue buying Treasuries and mortgage-backed securities at the rate of about $80 billion/month for the foreseeable future. As for the employment report, average hourly earnings rose only 1.7% over the past 12 months, while the CPI increased 2.2%! The workweek remained unchanged at 34.4 hours. September and October employment gains were collectively reduced by 49,000.

Agricultural Economics

Despite crippling drought, US food prices will rise little as only 15% of each food dollar is attributable to farm products. Thus, even a 100% rise in corn prices would lift the CPI by 1.5%. And if this drought is as bad as 1988, which cost $80 billion, GDP will fall by just 0.50%. In the short-run beef prices will fall as herds are culled due to high feed costs.