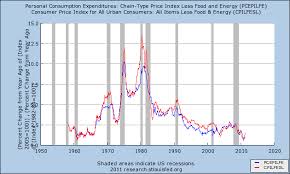

Inflation as measured by the CPI is 2.1%, as measured by personal consumption expenditures (PCE) is 1.6%, below the Fed’s 2% target. Importantly, the Fed uses the PCE to monitor inflation. Historically, the PCE is 0.5% lower than the CPI, as is the case now. The reason; the PCE accounts for changes in consumer buying habits as prices change, and it covers more than just out-of-pocket spending, like medical care.

Tag Archives: PCE

More on Q4 GDP

Q3 saw a boost to GDP due to inventories so the Q4 reversal must be seen in that light. Monday’s personal income & spending report gave details on how ’10 ended. Real personal consumer expenditure (PCE) spending rose 0.4% MoM in Dec but real personal disposable income was up only up 0.1%. How? Because consumers reduced savings to 5.3% from 5.5%. Absent that PCE would have been 0.1% not 0.4%.