With the Fed (and everyone else) forecasting improved economic conditions in the second half of ’13, it’s not surprising that the Fed again reiterated that it MAY start tapering QE3 later this year. Interestingly, the Fed has been consistently over-optimistic when it comes to forecasting. Thus, I still think tapering commences no earlier than November. But, if monthly job creation numbers stay above 183,000/month, tapering could commence in September.

Tag Archives: Bernanke

No Free Lunch

With the Fed, the Bank of England and recently the Bank of Japan engaging in massively expansionary monetary policy, central banks in South Africa, India, Australia, Poland, Korea, Denmark, Israel and elsewhere are lowering their interest rates too. They are doing this to stimulate growth and in some cases prevent their currencies from appreciating and hurting exports. To the extent it’s the latter, these actions blunt some of Bernanke’s objectives.

Of Interest

The interest rate setting Federal Reserve Open Market Committee always includes the seven Governors of the Federal Reserve System and the President of the Federal Reserve Bank (FRB) NY. The remaining four members rotate among the Presidents of the other 11 FRBs. For policy purposes, the rotating members don’t matter. Moreover, Governors Fisher, Lacker and Plosser all of whom are calling for an end to QE3, aren’t currently voting members.

Inflation to the Rescue

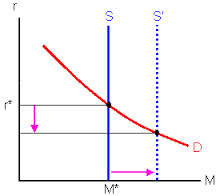

Rather than more quantitative easing, the Fed should stop targeting inflation and instead aim for a consistent level of nominal (unadjusted for inflation) GDP (NGDP) growth over the cycle. With this approach, the Fed would goose NGDP growth when times are bad (like now), by allowing more inflation, but restrain inflation when times are good. This way the Fed can use inflation rather than ignoring it to accomplish its goals.

Quantitative Uneasy

While Bernanke undoubtedly wanted to do more in the way of monetary stimulus than he did, yesterday’s Fed’s decision to explicitly commit to keeping rates low through late ’14, was the best he could do in place of another round of quantitative easing. Recall that bond purchases (QE1 and QE2) have become increasingly unpopular with some investors and many Republicans who consistently (and mistakenly) believe that they will eventually lead to higher inflation.

Wrong at the Reserve

If you didn’t predict the housing bust, don’t feel bad, the Fed totally blew it too. Reading just released minutes from the ’06 meetings, is hysterically funny were it not so tragically sad. Bernanke was confident of a soft landing (really?) and most of the others were sure that any problems in the housing sector would not weaken GDP growth or harm the rest of the economy! Separately, GDP growth for Q4 ’11, will be less than 2.5%.

No Inflation

Bernanke and a majority of Fed officials predict that the surge in oil prices will lead only to a modest and short-lived increase in consumer prices as firms will have a very tough time passing cost increases on to consumers as slack in the labor market keeps wage increases to a minimum. Thus, inflation is playing the role of Elvis – plenty of possible citings, none confirmed.