With passage of the American Taxpayer Relief Act of 2012 (the fiscal cliff bill), the residential real estate industry dodged a bullet. While Schedule A deductions are phased out for couples with incomes above $300,000, the phaseout is mild. A couple with $500,000 of income would be $200,000 over the $300,000 limit. Thus, their deductions fall by 3% of the $200,000 overage, ($6,000), which raises their taxes by about $2,400.

Tag Archives: Fiscal Cliff

Congressional Cowards

Only by pushing off all hard decisions was Congress able to prevent us from going over the fiscal cliff. Now we face Debt Ceiling Battle II which must be resolved by March, a fight over annual spending cuts of $100 billion which after being postponed now commence in March, and a government budget that expires in, yup, March! Based on what we’ve seen, the next few months will be terrifying.

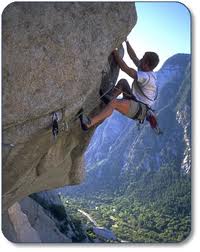

Cliff-Hanger

Washington will not solve the Fiscal Cliff during the lame duck session of Congress. Rather, they’ll pass a stop-gap measure raising the debt ceiling and more importantly giving themselves more time to pass revenue-positive tax reform, consisting of broadening the tax base and lowering marginal tax rates. As now structured the Cliff mixes about $4 in tax hikes for each $1 in spending cuts; minimally, it must be balanced.