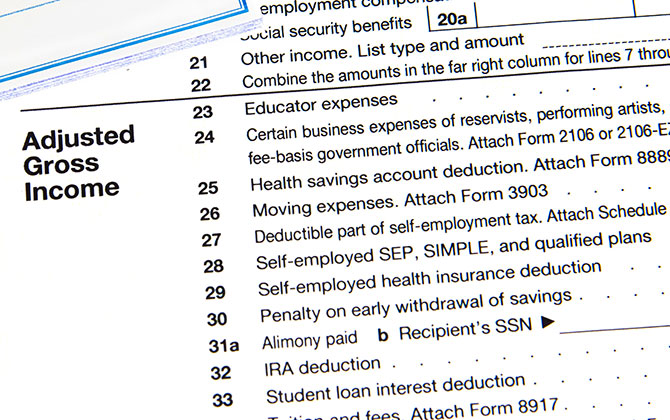

In 2015, the top 1% of individual filers, those with AGIs (adjusted gross incomes) of at least $480,930, earned 20.65% of total AGI and paid 39.04% of all federal income taxes. The top 5% had AGIs of $195,778 and paid 59.58% of total income taxes and the top 10%, with AGIs of more than $138,030, paid 70.59% of taxes and earned 47.36% of all AGI. These numbers exclude payroll taxes.

In 2015, the top 1% of individual filers, those with AGIs (adjusted gross incomes) of at least $480,930, earned 20.65% of total AGI and paid 39.04% of all federal income taxes. The top 5% had AGIs of $195,778 and paid 59.58% of total income taxes and the top 10%, with AGIs of more than $138,030, paid 70.59% of taxes and earned 47.36% of all AGI. These numbers exclude payroll taxes.